Can we rely on Bitcoin to be a real safety net from the downcast US dollar? The solution is not exactly obvious and not the same as crypto enthusiasts would quickly claim. With the decreased global power of the US dollar to deal with, a number of investors view Bitcoin as a possible method of protecting investment. Though, it’s essential to be aware of the intricacy of the relationship between the two financial superpowers before buying into the cryptocurrency hype.

The analyst here will deal with the following questions:

- The real impact of dollar devaluation on your wealth

- Whether Bitcoin is an inflation hedge or not

- The principal factors that are determining the stability of both currencies

- Expert opinions about the different strategies of portefeuille diversification

You might be a jittery investor who is doubtful about the greenback’s fading purchasing power or you might just be interested in the current Bitcoin trend. Anyway, with the information in this in-depth guide, you will surely find the fruit of opportunity for an insightful decision about your financial future. Now, let’s separate the wheat from the chaff and see if it’s certainly good for Bitcoin. More personalized help that fits the situation you are in can be offered by a professional financial advisor.

Basic Concepts of the World Economy

The world economy is a complex structure that involves the participation of many countries, numerous markets, and the performance of multiple financial transactions. The world economy is led by the U.S. dollar, which has historically been the most dominant global reserve currency.

The US dollar has become the reserve currency primarily because it is widely used internationally for trade and financial transactions and also because it is considered stable and secure. However, in the past few years, existing patterns and situations have created doubts about the future of the dollar.

The existence of other currencies, e.g., the Chinese yuan and the euro, has strengthened the trading and financial relationships between the countries of the world, thereby lowering the dollar’s overall worth on the international markets.

Consequently, the dominance of the dollar, its behavior, and the influence on the international economy are currently the subjects of quite an observant eye.

Key Takeaways:

- The weakening US dollar in global trade and the fall of the reserve currency status, along with the growing federal deficit, has provoked warnings about financial stability in the long run.

- Though Bitcoin is widely publicized as a hedge against dollar devaluation, the cryptocurrency is accompanied by a set of its own fluctuation risks and market uncertainties.

- While the fight against inflation might be the main point of the crypto, the discussion about the most important factors like market capitalization or bitcoin price fluctuations cannot be avoided.

- Real estate, as one example, and many small and mid-cap companies can be incorporated into the investment portfolio selections that one could use to hedge against economic instability.

- The changing of the money value by the government and the success of the central bank in this process are among the ways that determine the growth of the bitcoin market and the weakening of the US dollar’s position.

Main Obstacles for the US Dollar

Economic Aspects

The US dollar is continually in a struggle with various economic issues that may lead to its downfall. A persistent trade deficit has been gradually deteriorating, reaching the point of becoming unprecedented levels, as acquisitions logically outstrip the number of goods being given up. This lack of equilibrium is the very foundation of the dollar and is the primary reason it has the potential to lose its worth in the long run.

There are fears related to the soaring national debt figures, particularly when government has consistently been outstripping the revenue generation for years. Such a situation creates a huge imbalance in the country’s fiscal regulations, and many market analysts assume that the dollar’s value will eventually wane and consequently shake the confidence of international investors.

Political influences

Governments and their actions can have profound effects on the value and stability of the U.S. dollar. The recent global trade war was a trigger in the world of diplomacy and foreign relations that became detrimental to international relations as it led many countries to look for alternate sources of the trading currency. Thus subjects that were only discussed at a slow speed gave a push to the depaz actual dollar dependency in the international market for the right occasions going as far as to cut it down.

Along with the political deadlock in congress over the fiscal policies and the debate over the debt ceiling, internal issues of a nation make these challenges even harder to overcome. According to the media, Thomas Massie who is an American politician stated that people are more likely to lose trust in the US dollar as the instability of the government becomes more evident.

Global market dynamics

It is around the world in the field of finance that we are witnessing the rise of new challenges that would be a threat to the supremacy of the dollar. More and more new economies are showing signs of their desire to lessen ties with the US currency to the extent of moving towards the creation of alternate payment channels, and bilateral currency deals.

Currency use as a part of the constant flow of the global economy has become exceedingly visible today wherein the euro and the Chinese renminbi are considered as game-changers. This transformation does not only open the door for the idea of a multi-currency global economy but it also makes it possible for reserves to be held and trade to take place in various currencies.

Furthermore, the upsurge in the popularity of virtual money and the move of de-dollarization lead by some countries are adding more weight to the already pressurized situation. These new trends in global market dynamics are showing the potential to even fully destabilize the conventional dollar-centered financial system.

Different central banks around the world are looking for other ways of diversifying their reserves as they are decreasing their holdings in the dollar. The trend of reducing the shares of US-dollar holdings is not yet an urgent matter, but it already indicates a slow but continuous change in the global monetary order.

💡 Key Takeaway: The US dollar faces a complex web of challenges from economic imbalances, political tensions, and shifting global market dynamics, potentially threatening its long-term stability and international dominance.

Understanding the Dollar’s Reserve Currency Status

An essential part of the dollar’s status as the world’s reserve currency is the share of US dollars which central banks and foreign investors have as part of their foreign exchange reserves.

Additionally, the use of the dollar as the main currency in the international trade and pay of a lot of trade and financial transactions, including the purchase of commodities like oil, give support to the status of the dollar as a global reserve currency.

Besides, the dollar’s reserve currency status is not a given. A potential collapse of the dollar would result in economic instability, inflation, and a fall in the value of assets denominated in dollars. Therefore, the scrutiny and potential challenges of the dollar’s position as the global reserve currency are going to be intensified as new solutions are opened by other countries and central banks.

Bitcoin as an Alternative to the Dollar

Bitcoin is growing in popularity, as conventional currencies have come under some serious pressure, and it is considered an interesting seismic shift in the world of finance. The guiding principles of Bitcoin which include the decentralized system and the limited supply, present some distinguishing features that make it unique in comparison with the usual money we know.

Debates about the future of Bitcoin in financial circles are common and it is often referred to as a possible exit from the fiat system, especially in the context of the worrying stability of the U.S. dollar.

Pros Of Traditional Money

Bitcoin has numerous advantages as an alternative to traditional money. Besides its enormous market capitalization, Bitcoin also gives the world fake independence from the central bank’s monitory policies and banking systems.

In a parallel way, fiat currencies are not like Bitcoin because the availability of the first is determined by the central bank while Bitcoin’s, on the other hand, is 21 million which is a small number of coins and can be used to hedge inflation.

This also facilitates the high-speed movement of money across the international borders without the need of banks as intermediaries that digital currencies offer insuch an amazing way. In the past few months, Bitcoin has become a highly desirable medium of exchange in economies suffering from bad financial health and where the money outflow has been restricted.

The introduction of blockchain technology has many benefits such as the fact that the transactions are open to the public which reduces the probability of a fraudulent application. The storing of wealth in various assets such as Bitcoin can help mitigate the risks related to changes in the economy.

Downsides and Drawbacks

The high volatility of Bitcoin, which is at the same time its strong economic trait but also its biggest economic weakness, is of the major forbidding nature to its becoming a reliable financial asset. The Bitcoin price is one of the most unreliable in value and can easily lead to huge upward and downward fluctuations over a relatively short space of time. It is nearly impossible for the stakeholders, the merchants, and people in general to use it for everyday transactions due to this phenomenon.

We cannot disregard the fact that the youthfulness of the cryptocurrency and the slow pace of the legislative process leave a cloud of uncertainty. The safety issue of the exchanges and the protection of the private keys, which can be lost, are among the top concerns. The negative environmental impact resulting from the excessive power consumption of the miners has started to take effect on the ecological system.

What is more, the fixed supply of Bitcoin might also result in deflationary pressures that would stimulate a decrease in prices, if widely circulated. This feature could contribute to a situation where consumers and entrepreneurs are less likely to spend and invest, which can negatively affect the economy.

💡 Key Takeaway: Despite the fact that Bitcoin stands out as a feasible alternative to the traditional currency by way of its decentralized, limited supply, yet the unstable price of Bitcoin as well as the current, not-fully-resolved technical issues stands in the way of it becoming a full replacement for the dollar.

The Role of Interest Rates

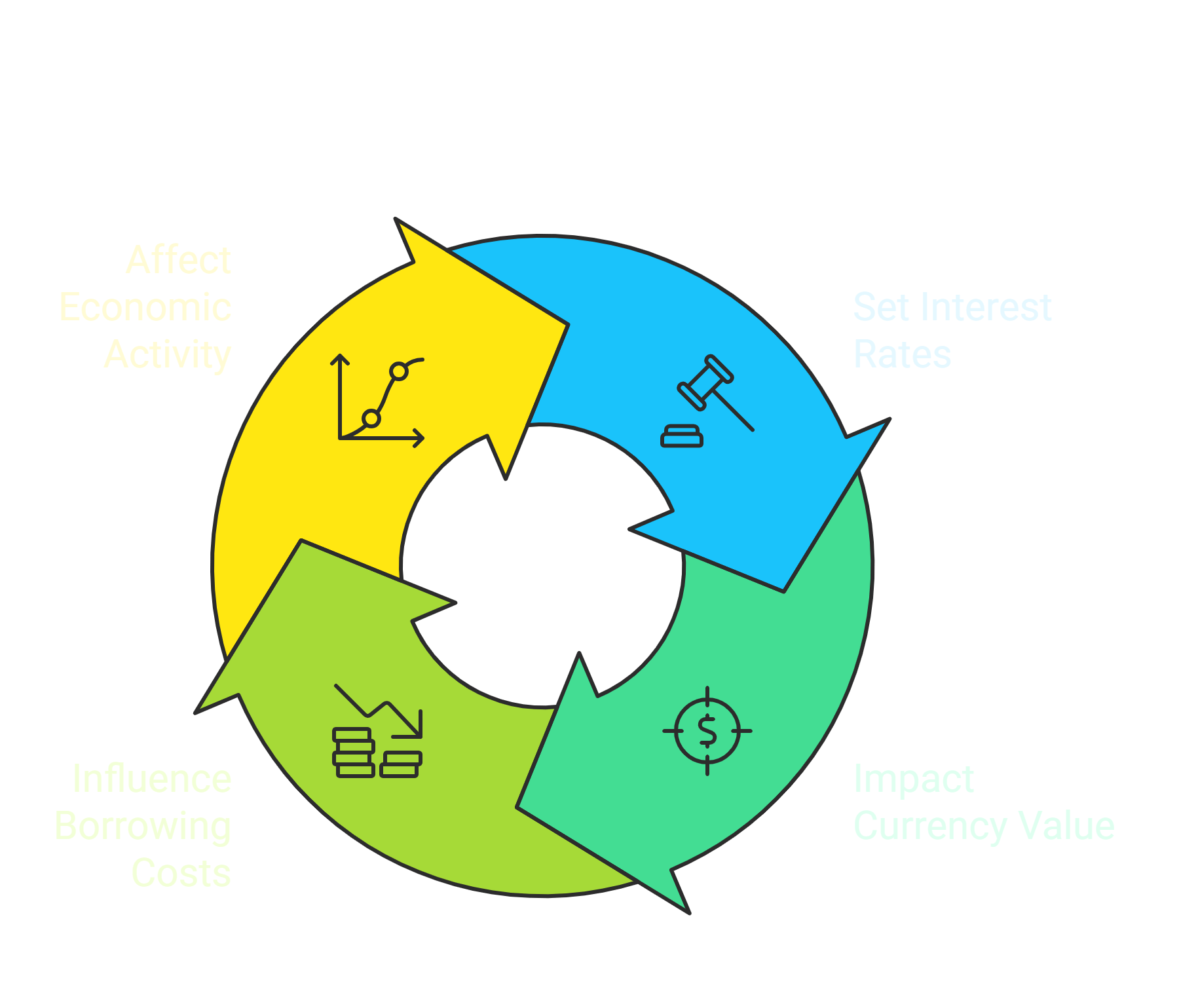

Interest rates make one of the major world economics’ spinners. They determine the value of the currency, borrowing cost, and, ultimately, the overall economic activity level. The “Fed,” in other words, the United States central bank, stipulates the maximum employment, stabile prices, and moderate long-term interest rates by adjusting the interest rates. Although, interest rates are the main monetary policy tool, they may have a high impact on the economy as well.

A decrease in the dollar’s value will be the result of the lower interest rate, i.e. the currency will depreciate, which will lead to fewer foreign investors buying into the currency. Alternatively, higher interest rates will have the effect of making it more expensive for a foreign country to borrow dollars and thus will cause the dollar to fall in value, as it will generate less demand for it. Consequently, the knowledge and comprehension of these driving forces is an indispensable skill in the management of the economic system of the world.

The Housing Market and Economic Uncertainty

The housing market is one of the most important industries in the global economy, and economic uncertainty undeniably plays a huge role in housing market performance. Increased interest rates can make it difficult for consumers to pay for their homes which in turn will result in less housing market activity. Furthermore, the turmoil in the economy could also result in consumer spending decreasing, consequently decreasing the overall economy.

Just to mention a few, a decrease in consumer spending can bring about a demand decrease for goods and services hence a slowdown in the growth of the economy. The housing market is, in addition, influenced by the dollar’s worth. When the dollar is stronger, it makes the prices of U.S. homes relatively higher, so, it is not likely that potential foreign buyers will be attracted to the American market.

On a final note, the global economy is a multifaceted learning space open to manipulation by numerous factors, among them the cost of borrowing, bond yields as well as economic uncertainty. The reserve status of the dollar is maintained by central banks and foreign investors which is, however, the fact that if the dollar collapses, there will be some risks. Learning how interest rates, bond yields, and the housing market work is indispensable for operating and making well-planned investments in the global economy.

You can always think about these variables and their influence on the value of the dollar, which will allow you to make comparisons side by side and choose the most adequate path forward and at the same time diminish the possible risks.

Summary

If we further look at how Bitcoin is intertwined with the weak u.s dollar, we can undoubtedly say that cryptocurrency is not a magic bullet when d… Moreover, the unstable nature of Bitcoin and the ever-changing regulations impose the necessity of careful consideration before deciding to invest.

The main idea is that in most of the cases financial health is achieved through diversification rather than putting all your eggs in one baske… Your investments portfolio whether it is in Bitcoin, in the traditional assets, or a mix of both, has to be in line with your risk.

The financial sector of the world is continually moving forward, and being well-versed in the field of traditional and digital currenc… The Schwab Center for Financial Research views on alterations in the global economic dynamics that highlight the importance of exp… Bear in mind that safeguarding your wealth in times of economic uncertainty demands a balanced mix of tactics.

FAQs

Is Bitcoin more stable than the US dollar during economic uncertainty?

From one side Bitcoin can be seen as a safe haven for dollars that are expected to lose value due to the increasing supply trickling from the efflux printing and control of the pace of currency expansion, but generally, Bitcoin is quite volatile in comparison to dollars.

The price of Bitcoin may fluctuate a lot because of market sentiments, legal news, and technological advancement, thereby making it less stable during economic uncertainties.

How does Bitcoin’s energy consumption impact its viability as a dollar alternative?

The energy-consuming process in Bitcoin mining requires a lot of energy, thus leading to negative environmental effects. The high energy requirement is a roadblock to the scalability that might have an adverse effect on its future viability as an alternative currency worldwide, especially when the world is moving toward environmentally friendly solutions.

Can Bitcoin and the US dollar coexist in the global financial system?

There is no doubt in the possibility of Bitcoin and the US dollar coexisting in the global financial system. In this case, Bitcoin is an instrument of digital value storage and a potential hedge against inflation, dollar, on the other hand, is still an essential part of global trade, financial markets, and international reserves.

What role do central banks play in Bitcoin’s relationship with the dollar?

These two forms of money are affected by central banks’ actions, although central banks’ influences on the two are different. The Federal Reserve has the sole authority to influence the dollar while Bitcoin runs under a decentralized organization. Their attitudes concerning cryptocurrency regulations and digital currencies can determine Bitcoin’s adoption levels and the currency’s fair market value.

How does global trade tension affect Bitcoin’s position against the dollar?

The attractiveness of Bitcoin as an alternative asset can be increased by trade worries and policy doubts. In periods of global trade disputes or if the economy is unstable, a segment of the investment community would consider Bitcoin as a riskless investment, which, in turn, might lower the price of the dollar.

How does the involvement of Bitcoin in ransomware attacks affect the credibility of the currency?

Recent ransomware attacks that used Bitcoin as a means of payment have triggered questions about the authenticity of cryptocurrency as a legal means of exchange. Because such episodes have been so few, Bitcoin transactions have lost a very small percentage and they may still be one of the legitimate financial instruments.