Digital Shield and What Happens If It Breaks: A Deep Dive into Cryptography and Its Importance

Cryptography is a cornerstone of modern cybersecurity, protecting the integrity, privacy, and authenticity of digital data. From the messages we send on social media to the financial transactions we make online, cryptographic systems serve as the shield that guards our digital lives. This “digital shield” is built on complex algorithms, encryption methods, and protocols that make it extremely difficult for unauthorized users to access, alter, or counterfeit sensitive information. However, what happens if this digital shield breaks? What are the consequences of a failure in cryptography, and how would it affect our daily lives? This article will explore the critical role of cryptography in our digital world, the importance of its security, and the potential ramifications of a cryptographic failure.

What Is Cryptography?

At its core, cryptography is the practice and study of securing communication and data in the presence of adversaries. It involves techniques that ensure the confidentiality, integrity, and authenticity of information by transforming data into unreadable formats that can only be decoded by authorized parties.

There are two primary aspects of cryptography:

- Encryption: The process of converting plaintext data into a scrambled format (ciphertext) to prevent unauthorized access.

- Authentication: Ensuring the identity of users or systems to guarantee that only legitimate parties can access or modify the data.

Cryptographic methods rely on mathematical algorithms, keys, and protocols to function. These techniques are applied in various areas of digital life, such as:

- End-to-end encryption in messaging applications

- Public-key infrastructure (PKI) in securing websites via HTTPS

- Digital signatures to verify the authenticity of documents

- Hash functions to ensure data integrity during storage and transmission

The Digital Shield: How Cryptography Protects Us

Cryptography acts as a protective barrier, much like a shield, that prevents unauthorized individuals from accessing private data. Here’s a closer look at how cryptography works to safeguard our digital information:

- Data Confidentiality: Encryption ensures that sensitive data—whether it’s credit card information, login credentials, or private conversations—is only accessible to those authorized to view it. For instance, when you use your banking app, your password and transaction details are encrypted so that even if an attacker intercepts the data, they cannot read it.

- Data Integrity: Hashing and digital signatures ensure that data has not been tampered with during transmission. For example, when you receive a file or an email attachment, a cryptographic hash can confirm that the content has not been altered by malicious actors.

- Authentication: Public-key cryptography enables systems to verify the identity of users and services. By using a combination of public and private keys, a website can verify that it is communicating with the correct user and that the data is being exchanged with the intended party.

- Non-repudiation: Digital signatures ensure that once a message or transaction has been signed, the sender cannot deny having sent it. This is particularly important for legal, financial, and business transactions.

- Secure Communication: In communication protocols such as TLS (Transport Layer Security), cryptography ensures that data is transmitted securely over networks like the internet. Without cryptography, your internet activity could be easily intercepted and manipulated by malicious parties.

The Risks of a Cryptographic Breakdown

While cryptography is highly effective in safeguarding digital information, it is not infallible. A breakdown in cryptographic systems or a breach in cryptographic protocols could have catastrophic consequences. Let’s explore what could happen if this “digital shield” were to break.

1. Loss of Data Confidentiality

One of the most critical outcomes of a cryptographic breakdown is the exposure of sensitive data. If encryption methods fail, hackers could easily intercept, read, and steal personal information, such as passwords, credit card numbers, and private messages. This breach could lead to identity theft, financial fraud, and the leakage of sensitive business data.

For example, imagine an attacker exploiting a vulnerability in an encrypted communication channel. If this happens, it could expose confidential communications between businesses, governments, or individuals, leading to a loss of privacy and security.

2. Compromise of Data Integrity

If cryptographic hashes or digital signatures fail, the integrity of the data could be compromised. Attackers could alter data without detection, making it impossible to trust the authenticity of the information. This could have dire consequences in sectors like healthcare, where tampered medical records could lead to misdiagnoses, or in finance, where altered transactions could result in financial losses.

For instance, if a government or financial institution’s digital signature is no longer valid due to a broken cryptographic system, counterfeit documents could be created, or fraudulent transactions could be executed without detection.

3. Authentication Failure

When authentication systems based on cryptography fail, attackers could gain unauthorized access to sensitive accounts or systems. A compromised authentication system could result in data breaches, where attackers access private accounts, steal personal information, or manipulate data.

For example, if the private key used to secure access to a system is stolen or compromised, an attacker could impersonate a legitimate user, access confidential files, or even initiate fraudulent activities on a victim’s behalf. Such breaches could lead to financial and reputational damage.

4. Loss of Trust in Digital Systems

A widespread cryptographic failure would erode trust in digital systems, causing panic and instability. If users can no longer rely on the security of encryption and authentication mechanisms, they may avoid using online services, leading to a decline in digital commerce and communication. This could also lead to the collapse of online platforms that rely on cryptography for their security model.

For example, if a digital payment platform or an e-commerce website suffers a cryptographic breach, customers may lose confidence in the platform’s ability to safeguard their financial data, leading to a loss of customers and revenue.

5. Impacts on Global Security

Cryptography plays a vital role in securing global networks, protecting national security, and enabling safe communication between governments and military entities. If cryptographic systems were to fail, it could expose classified data, national secrets, and sensitive government communications to hostile entities. In a worst-case scenario, this could compromise national security, destabilize governments, and increase the likelihood of cyber warfare.

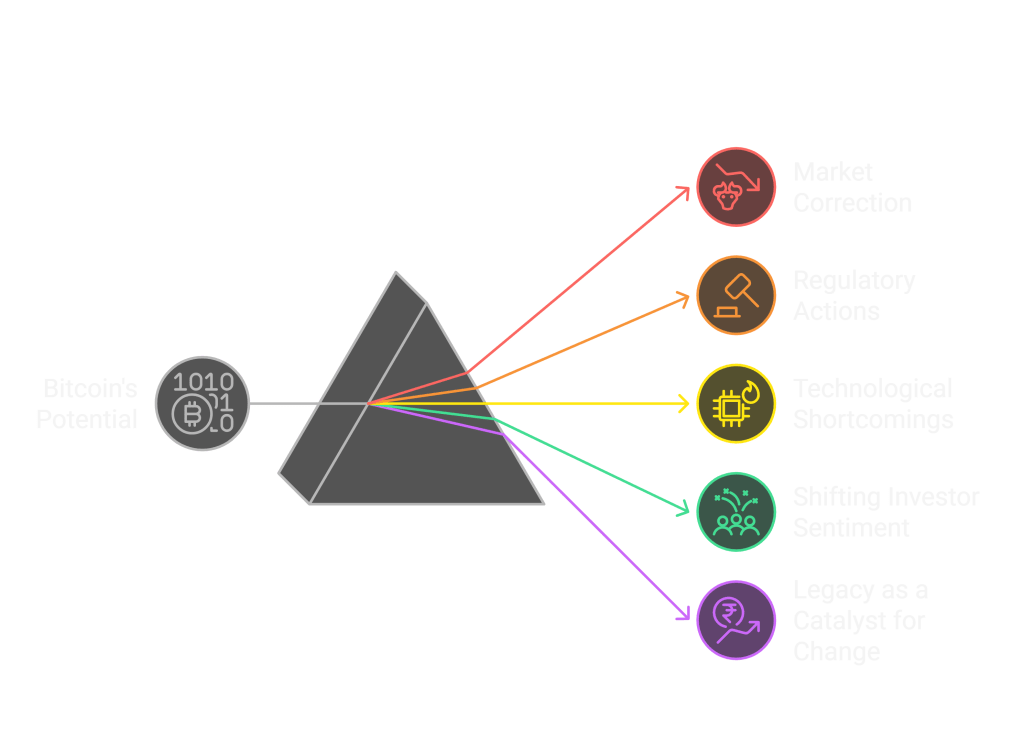

6. Compromise of Digital Currency Systems

Cryptocurrencies rely heavily on cryptographic algorithms to ensure the security and integrity of transactions. If the cryptographic foundation of a cryptocurrency, such as Bitcoin or Ethereum, were to break, it could lead to double-spending, theft, and loss of trust in digital currencies. In this scenario, the entire cryptocurrency market could collapse, affecting millions of investors and financial institutions worldwide.

What Happens If Cryptography Breaks: How to Mitigate the Risks

While a cryptographic failure could have severe consequences, there are steps that individuals, businesses, and governments can take to mitigate the risks:

- Regular Updates and Patches: Cryptographic algorithms, protocols, and systems should be regularly updated to address vulnerabilities. Security patches should be applied to prevent attackers from exploiting weaknesses in the system.

- Quantum-Resistant Cryptography: As quantum computing advances, there is a growing need for cryptographic algorithms that can withstand attacks from quantum computers. Quantum-resistant cryptography is already in development to prepare for this future threat.

- Multi-Factor Authentication (MFA): To strengthen authentication, businesses and individuals can adopt multi-factor authentication, which requires multiple forms of verification, such as passwords and biometric data, in addition to cryptographic methods.

- Backup and Recovery Plans: In the event of a cryptographic failure, backup and recovery systems should be in place to minimize data loss and system downtime. Regularly backing up encrypted data ensures that critical information can be restored.

- Transparency and Auditing: Organizations should employ transparent cryptographic systems that are subject to independent auditing. This ensures that the cryptographic processes are secure, and potential vulnerabilities are identified and addressed.