Understanding Cryptocurrencies

Cryptocurrencies are digital assets that use technology to secure and verify transactions. They rely on a system where users control their money without banks or middlemen. To understand how to invest, I first need to explain what these digital currencies are, how the technology behind them works, and the main types you might encounter.

What Are Cryptocurrencies?

Cryptocurrencies are digital money secured by cryptography. Unlike traditional currency, they are not controlled by a government or bank. Instead, they work on a decentralized network. This means that transactions and records are verified by many computers around the world.

Bitcoin was the first cryptocurrency and remains the most well-known. Others like Ethereum offer more features, such as supporting smart contracts and tokens. Cryptocurrencies can be used for buying goods, investing, or as digital assets to hold value.

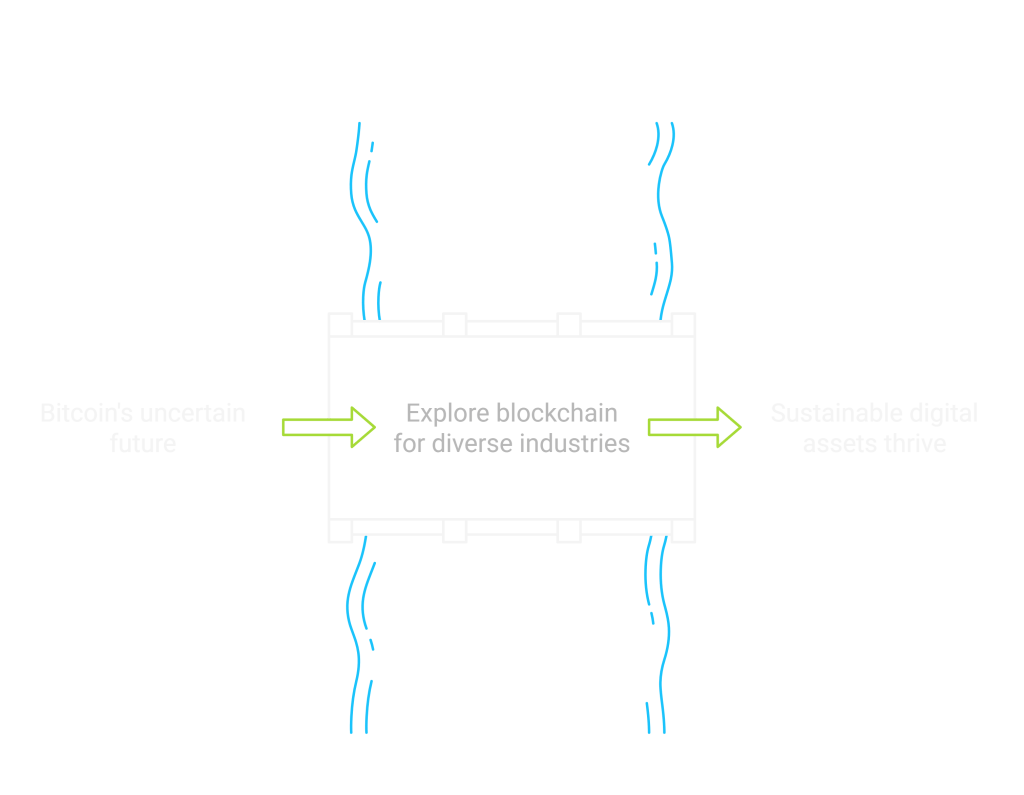

How Blockchain Technology Works

Blockchain technology is the backbone of cryptocurrencies. It is a public ledger that records every transaction on a network. This ledger is shared across many computers, making it very hard to alter or hack.

Each new transaction forms a “block” that gets added to a chain of previous blocks. This structure ensures transparency and security. Because it’s decentralized, no single person or company controls the blockchain. This trustless system lets participants verify transactions without intermediaries.

Popular Cryptocurrencies and Tokens

Bitcoin, Ethereum, and Dogecoin are some of the most popular cryptocurrencies. Bitcoin mainly works as a store of value and a digital currency. Ethereum, however, lets developers create applications and new digital tokens on its platform.

Tokens are units of value created on a blockchain. They can represent assets, rights, or access to services. For example, ether is Ethereum’s native token and powers transactions on its platform.

Here’s a quick look:

| Cryptocurrency | Purpose | Notable Feature |

|---|---|---|

| Bitcoin | Digital money, store of value | First and most widely used |

| Ethereum | Platform for apps and tokens | Supports smart contracts |

| Dogecoin | Digital money and tipping | Started as a meme, now popular |

Understanding these basics helps me see how the crypto space works and what to focus on when investing. For more detailed explanations, you can check this article on understanding cryptocurrencies.

Evaluating Crypto Investments

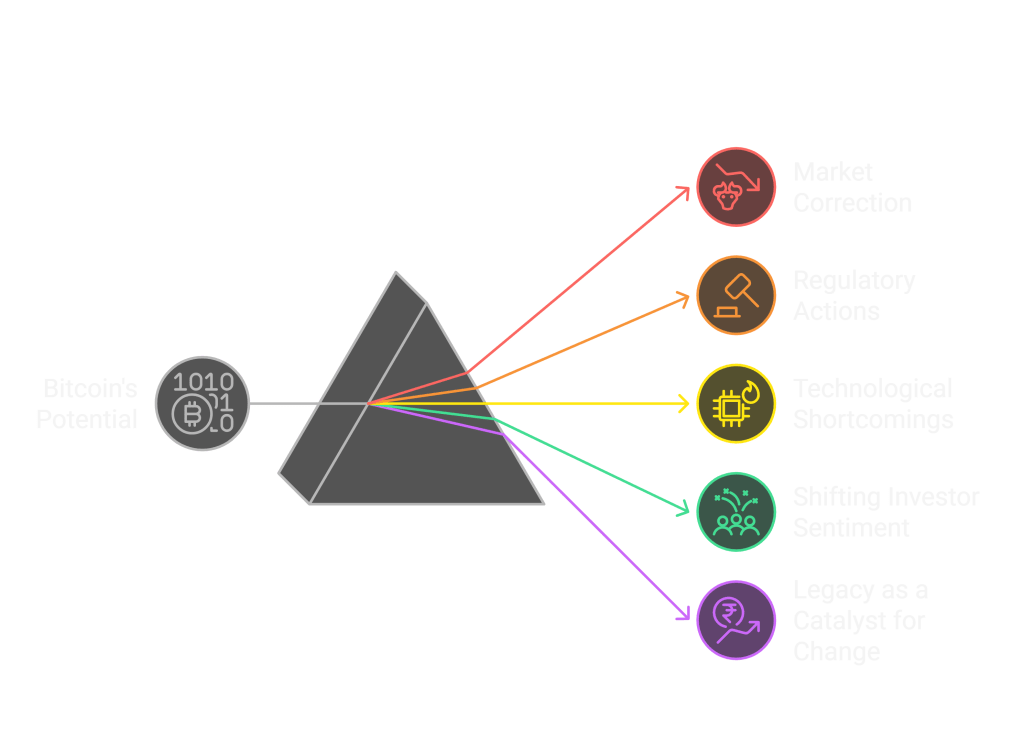

When I look at crypto investments, I focus on factors that affect how safe and flexible my money is. This means understanding how much prices jump, how easy it is to sell, and what risks come with certain types of crypto assets.

Assessing Volatility and Risk

Volatility is a key part of the crypto market. I know prices can change wildly in short periods, which can lead to big gains or losses. To manage this, I watch the price history and market trends carefully.

I also look at what drives these price swings, such as news events, regulatory changes, or shifts in investor sentiment. High volatility means higher risk, so I only invest money I can afford to lose in these situations.

Using tools or models that evaluate risk under uncertain conditions helps me make better decisions. For example, fuzzy logic models can show the potential risks more clearly in complex markets like crypto.

Liquidity Considerations

Liquidity matters a lot when I invest in crypto. It means how quickly I can buy or sell a cryptocurrency without affecting its price. If a coin is highly liquid, I can enter or exit positions easily.

I pay attention to trading volume and the number of active buyers and sellers. Low liquidity often leads to higher price spreads, which can increase costs or make it harder to sell quickly.

Before investing, I make sure the asset is listed on major exchanges with steady trading activity. This way, I avoid getting stuck with an investment that is hard to cash out when needed.

Understanding High-Risk Investments

Some crypto investments carry more risk than others, especially newer or less popular tokens. These high-risk investments can offer big rewards but can also result in complete losses.

I never base my whole portfolio on high-risk crypto assets. Instead, I allocate a small portion of my funds for them, knowing the chances of failure are higher.

Factors like project legitimacy, team background, and community support help me judge if a high-risk coin might succeed. I treat these investments like experiments and stay ready to cut losses quickly if things go wrong.

For more on assessing crypto risks, you can explore studies on evaluating potential risks in crypto currencies or tools that use artificial intelligence in crypto investments.

Methods to Invest in Crypto

There are several ways I can invest in crypto, each with different risks and benefits. Some methods let me own coins directly, while others give me exposure without holding the actual cryptocurrency. Understanding these options helps me decide which fits my goals and risk level.

Buying and Holding Cryptocurrency

This method means I buy cryptocurrencies like Bitcoin or Ethereum and keep them in my digital wallet. I choose a reliable exchange to purchase coins using my bank account or credit card. After buying, I store coins in a wallet, either online (hot wallet) or offline (cold wallet).

Holding crypto for a long time lets me benefit from price increases. However, prices are volatile and can fall quickly. I must secure my wallet to avoid hacking and never share my private keys. This simple approach gives me full control over my assets but requires trust in the market’s future.

Investing in Crypto ETFs

Crypto ETFs (exchange-traded funds) let me invest in crypto without owning coins directly. These funds track the price of one or more cryptocurrencies and trade like stocks on regular exchanges. Investing in ETFs means I avoid managing wallets or private keys.

ETFs provide a way to include crypto in my portfolio with less hassle and regulated exchanges. However, ETF shares may not offer returns as fast as owning coins because of fees and fund management. Crypto ETFs can be found on major stock markets, making them accessible for traditional investors seeking crypto exposure.

Participating in Mining

Mining means using computer power to solve complex math problems that keep crypto networks running. When I mine, I earn new coins as rewards. Mining requires special hardware and high electricity use, so it’s best for people who can invest in the right equipment.

Mining is more common with coins using proof-of-work, like Bitcoin. This method can be profitable if I keep costs low and the coin’s price is high enough. However, mining is technical and competitive. Many people join mining pools to combine resources and share rewards.

Staking and Proof-of-Stake

Staking involves holding specific cryptocurrencies in a wallet to support network activities. In proof-of-stake systems, like Ethereum 2.0 or Cardano, staking helps validate transactions. I lock up my coins, and in return, I earn rewards.

Staking usually uses less energy than mining and can generate steady income. However, my funds are often locked for a set time and may lose value if prices drop. Staking is a good option if I want to support blockchain networks while earning passive rewards through crypto ownership.

For more about crypto investing methods, see Cryptocurrency methodologies and techniques.

Diversifying Your Crypto Portfolio

Spreading investments in different types of digital assets reduces risk and creates more stable returns. I focus on choosing a mix that balances growth potential with lower volatility. Managing the types of crypto I hold and their individual risk levels helps me protect my portfolio from sudden market changes.

Allocating Across Different Digital Assets

I divide my crypto investments among several digital assets like Bitcoin, Ethereum, and smaller altcoins. Bitcoin offers stability because it is the oldest and most widely accepted cryptocurrency. Ethereum brings utility through smart contracts, making it popular in the crypto market.

Smaller altcoins can provide higher growth but come with more risk. To manage this, I limit my exposure to these riskier assets to a smaller percentage of my portfolio. This way, if one altcoin fails, it won’t have a huge negative impact.

Using a mix improves diversification by spreading risk. Investing in only one cryptocurrency can leave me vulnerable to sharp price swings. This approach reflects findings on diversification in crypto portfolios from studies like those found in crypto portfolio diversification research.

Balancing Stablecoins and Altcoins

Stablecoins, pegged to assets like the US dollar, offer low risk and liquidity in my portfolio. They act as a safe place to park funds during high volatility periods in the crypto market. Holding stablecoins lets me quickly seize new investment opportunities without having to convert from fiat currency.

Altcoins, on the other hand, offer growth but can be very volatile. I keep an eye on the market trends and adjust the balance between stablecoins and altcoins based on risk tolerance. For example, if the market looks unstable, I increase my stablecoin holdings.

By balancing stablecoins and altcoins, I can manage risk while still aiming for profits. This balanced mix helps me respond to changes in the crypto market more effectively and protects my portfolio from big drops. This method is supported by research on including stablecoins in investment portfolios for diversification benefits, as noted in investigations of crypto portfolio diversification.

Crypto Trading Strategies

To invest successfully in crypto, you need clear plans for how long to hold your assets, how to analyze the market, and how to protect your investments from risks. These ideas shape the choices I make daily when trading cryptocurrencies.

Short-Term vs Long-Term Trading

I divide trading into short-term and long-term approaches.

Short-term trading focuses on quick profits by buying and selling within hours or days. It requires constant attention to price changes and market news. I use techniques like day trading or swing trading in this style.

Long-term trading means holding cryptocurrencies for months or years. I rely on the belief that the asset’s value will grow over time due to market adoption or technology improvements. This method takes less daily effort but needs patience.

Each style suits different goals. Short-term trading can bring faster returns but is riskier. Long-term trading is more stable but slower. I consider my risk tolerance and available time before choosing a style.

Market Analysis Techniques

Analyzing the crypto market well is key to making smart trades. I use two main methods:

- Technical analysis: Here, I study price charts and trading volumes to spot trends and patterns. Common tools include moving averages and support/resistance levels. This helps in predicting short-term price moves.

- Fundamental analysis: This involves looking at the coin’s project, team, technology, and market demand. For example, I check blockchain upgrades or partnerships that could raise the asset’s value over time.

I combine both methods, especially using technical analysis for entry and exit points and fundamentals for understanding long-term potential. Learning and adapting to new data keeps my strategy effective in the fast-changing crypto market.

Managing Trading Risks

Risk management is crucial for protecting my crypto investments. I set rules to limit losses and protect gains, such as:

- Using stop-loss orders to automatically sell if prices drop to a certain level.

- Never risking more than a small percentage of my total capital on one trade.

- Diversifying by investing in several cryptocurrencies, not just one.

I also avoid trading based on emotions or hype. Staying patient and disciplined helps me avoid mistakes. Managing risks well makes a difference in staying in the crypto market long-term and avoiding big losses.

For more insight into trading strategies in the crypto market, see trading strategies in the cryptocurrency market.

Security and Storage

Keeping my crypto safe means controlling my private keys and choosing the right wallet. I also watch out for common scams that target investors. These steps protect my digital assets from theft or loss.

Securing Private Keys

My private keys are like passwords that let me access and control my cryptocurrency. If someone else gets them, they can steal my funds. So, I never share my keys with anyone.

To protect my private keys, I store them offline in secure places, such as hardware wallets or encrypted devices. Using multi-signature setups helps, where multiple keys are needed to approve transactions. This adds a layer of safety if one key is compromised.

I also back up my keys in multiple secure locations. If I lose access, backups let me recover my crypto. I avoid digital storage like email or cloud services because they are more vulnerable to hacking.

Choosing Wallets

I pick wallets based on security, ease of use, and compatibility with the cryptos I own. Hardware wallets are my first choice because they store private keys offline.

Software wallets on my phone or computer can be convenient but less secure. I use them only for small amounts or frequent trading. I make sure my devices have up-to-date antivirus and security patches.

Cold wallets are best for long-term holdings since they are not connected to the internet. Paper wallets can work but must be kept safe from damage or loss.

When choosing a wallet, I check reviews and developer reputation. Avoiding wallets without strong security features reduces risk.

Recognizing and Avoiding Scams

Scams come in many forms, such as fake websites, phishing emails, or Ponzi schemes promising high returns. I never trust offers that seem too good to be true.

Before investing, I research projects thoroughly. I verify official websites and use bookmarks to avoid phishing sites. I ignore unsolicited messages asking for private keys or payments.

I watch out for social media accounts impersonating real companies. If something feels off, I double-check on forums or trusted communities.

Using strong passwords and two-factor authentication protects my accounts from unauthorized access. Staying alert helps me avoid common traps that target crypto investors.

You can read more on risks related to crypto investments and security practices here.

Costs and Fees

When I invest in crypto, I know there are different fees I need to watch out for. These can add up and affect my overall returns. Some fees come when I make transactions, while others apply if I invest in crypto funds.

Transaction and Exchange Fees

Every time I buy or sell cryptocurrency, I pay transaction fees. These fees go to miners or validators who process my transactions on the blockchain. For Bitcoin, these fees can vary depending on network demand. When the network is busy, fees tend to be higher.

Exchanges also charge trading fees when I exchange one crypto for another or convert to cash. These fees are usually a small percentage of the trade amount. Some platforms offer lower fees if I trade higher volumes or use their native tokens.

Here is a quick summary of key costs:

| Fee Type | Description | Typical Range |

|---|---|---|

| Blockchain Fee | Paid to miners/validators | $1 – $50+ |

| Exchange Fee | Charged by crypto trading platforms | 0.1% – 1% |

Understanding these fees helps me decide when and where to make my trades to save money. More about transaction costs can be found in this systematic approach to cryptocurrency fees.

Management Fees for Crypto ETFs

When I invest in crypto ETFs, I face management fees. These are charged by the fund manager to cover operating costs. Fees for crypto ETFs tend to be higher than traditional ETFs because the funds handle digital assets and may deal with complex trading.

Typical management fees range from 0.5% to 2% annually. This cost reduces the overall return of my investment even if the fund performs well. If I hold the ETF for a long time, these fees add up.

Some ETFs maintain low fees to attract investors, but cheaper funds may have less active management or fewer services. It’s important to compare fees among available crypto ETFs now that the market is more competitive. This helps me balance costs versus expected benefits.

Emerging Crypto Sectors

New opportunities in crypto go beyond just buying coins. Some technologies focus on unique digital assets and finance without middlemen. These sectors offer new ways to invest and use blockchain.

Investing in NFTs

NFTs, or non-fungible tokens, represent unique digital items like art, music, or collectibles. Unlike regular cryptocurrencies, NFTs cannot be exchanged one-for-one because each token is different.

When I invest in NFTs, I look at the creator’s reputation and the item’s rarity. Popular platforms for buying and selling NFTs include OpenSea and Rarible. Prices can be volatile, so it’s important to research the market well.

NFTs give owners proof of ownership stored securely on the blockchain. This means digital art or assets can be bought and sold directly between people without needing a middleman.

Decentralized Finance and Applications

Decentralized finance (DeFi) uses blockchain to offer financial services without banks or brokers. This can include lending, borrowing, and trading through smart contracts—automated programs running on the blockchain.

I use DeFi platforms like Aave or Compound to earn interest or take out loans with crypto as collateral. These systems work 24/7 and don’t require approval from a bank or government.

DeFi applications aim to create a more open and accessible financial system. However, they come with risks like smart contract bugs or regulatory uncertainty. It’s important to understand how each platform works before investing.

Some DeFi apps combine multiple services, so you can trade tokens, earn rewards, and manage your assets all in one place.

Frequently Asked Questions

I’ve seen many investors ask about the best ways to start, how to handle small investments, and how to earn income from crypto. Safe practices and realistic earnings are also common concerns. These points can help guide your decisions clearly.

What are the first steps to investing in cryptocurrency for beginners?

I recommend starting by learning the basics of blockchain and crypto wallets. Then, choose a reliable exchange where you can create an account and verify your identity. Always start with a small amount to get familiar with trading and storing crypto safely.

What strategies exist for investing small amounts of money in cryptocurrency?

When investing small amounts, I focus on dollar-cost averaging. This means buying a fixed amount regularly instead of investing a lump sum. It lowers the risk related to price swings and helps build crypto holdings over time.

How does one generate income from investing in cryptocurrency?

You can earn income through price changes by buying low and selling high. Another way is staking, where you lock coins to support network operations and earn rewards. Some also use lending platforms that pay interest on crypto deposits.

What are some safe investment practices when dealing with cryptocurrency?

I always advise using hardware wallets to store your crypto offline. Avoid sharing your private keys and use strong, unique passwords. Also, double-check transaction details to prevent mistakes or scams.

Can I start investing in cryptocurrency with only $100, and how?

Yes, I started with small investments like $100. Many exchanges allow low minimum deposits. You can buy fractions of popular coins like Bitcoin or Ethereum, so you don’t need to buy a whole coin to invest.

What are the potential monthly earnings from investing in cryptocurrency?

Monthly earnings vary widely depending on the investment method and market conditions. For example, staking returns can range from a few percent to over 10% annually, which translates to a smaller monthly income. Trading profits depend heavily on market timing and risks.